grow your investment.

Tata Motors Demerger: Complete Details Every Investor Should Know

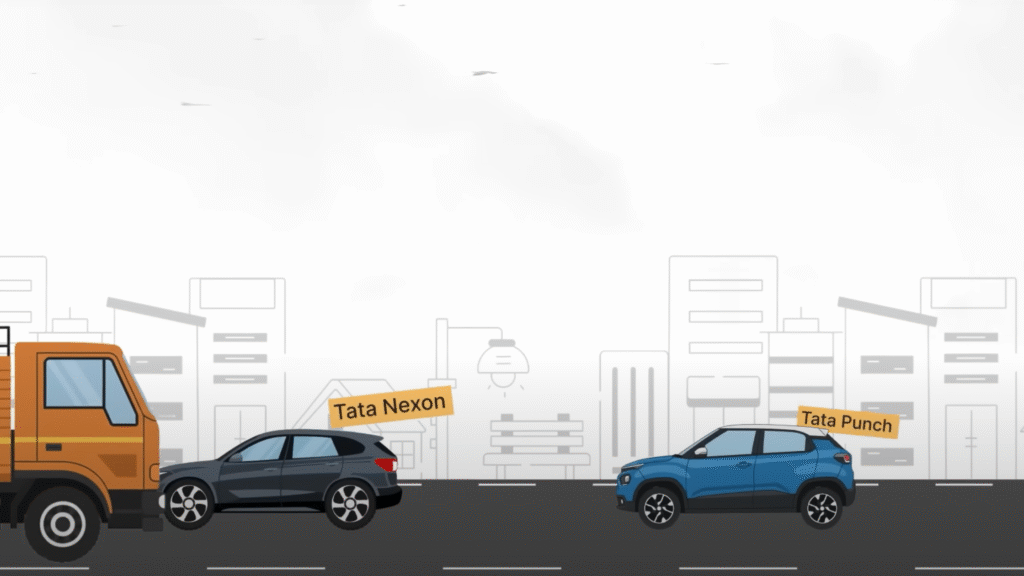

Tata Motors, one of India’s most iconic automobile giants, has announced a major corporate restructuring — the Tata Motors demerger. The company is splitting its business into two separate listed entities to bring better focus and growth potential to each division. Currently, Tata Motors operates two major segments under one umbrella — the passenger vehicle business, which includes cars like Nexon, Punch, and electric vehicles along with Jaguar Land Rover (JLR), and the commercial vehicle business, which includes trucks, buses, and pickups.

After the Tata Motors demerger, these two divisions will function as independent listed companies. Shareholders will receive one share of the new commercial vehicle company for every one share they currently hold in Tata Motors. For example, if you own 100 shares of Tata Motors, you’ll continue to hold those 100 plus receive an additional 100 shares of the new Tata Motors Commercial Vehicles entity.

The record date for the Tata Motors demerger is October 14, 2025, which means investors holding Tata Motors shares on or before October 13, 2025, will be eligible. On the record date, Tata Motors shares will go through a special pre-open price discovery session between 9:00 a.m. and 9:45 a.m. before regular trading resumes at 10:00 a.m.

Once the demerger is complete, the new Tata Motors Commercial Vehicle shares will be listed separately on NSE and BSE, typically within 30 to 45 days of the record date. Investors will receive a notification from CDSL once the new shares are credited to their demat accounts.

Financially, the Tata Motors demerger won’t change the total investment value, but it will adjust the average cost price between the two companies. For instance, if the demerger ratio is 60:40, the cost of your Tata Motors shares might be adjusted to ₹570, and the commercial vehicle shares to ₹380 per share, keeping your overall investment value the same.

From a taxation perspective, your holding period for the new shares will be counted from your original purchase date of Tata Motors shares. The tax on capital gains will apply only when you sell, with long-term gains (above ₹1.25 lakh) taxed at 12.5% and short-term gains at 20%.

Conclusion:

The Tata Motors demerger marks a strategic move to unlock value for shareholders, enhance operational efficiency, and allow each business to pursue focused growth in its respective market.

Recommended

All Time Plastics IPO Review

IPO GMP, Analyst Ratings,

Business and more.

All time plastics company that manufactures

plastic consumer goods....

Best Mutual Funds 2025 India:

A Data-Backed Guide.

We spent 7 months analyzing over 1500

mutual funds across 50+ parameters...

How to Create BEST Mutual

Fund PORTFOLIO 2025?

When it comes to building wealth through

mutual funds, one of the most common...

What Are ETFs and Why They

Might Be Better Than

Mutual Funds?

In recent years, the popularity of ETFs

(Exchange-Traded Funds) in India has...

Top AI Stocks in India To watch

in 2025.

In today’s discussion, we will look at the

top five AI (Artificial Intelligence) ...

YOU MAY ALSO LIKE